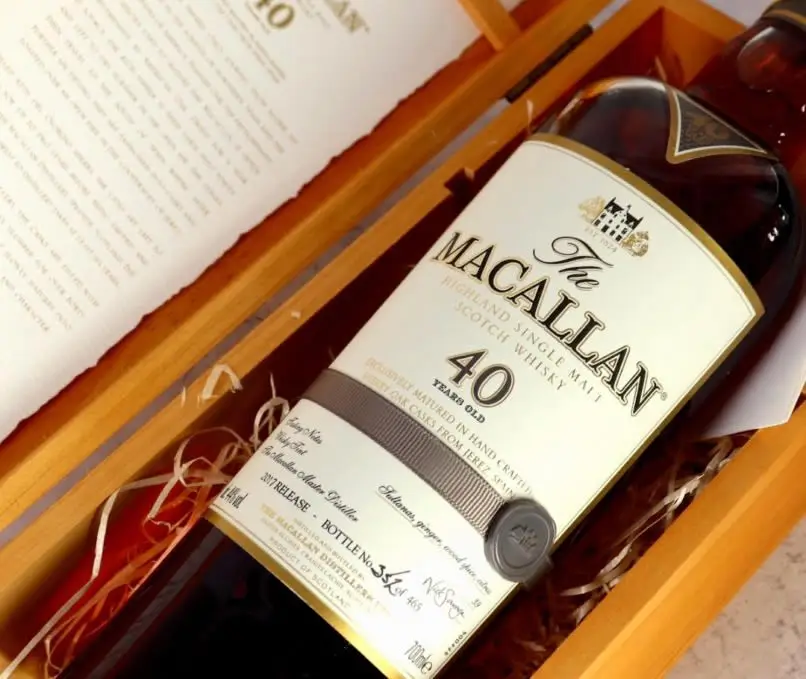

Whisky industry launches Water Stewardship Framework

The Scotch Whisky Association (SWA) has published a Water Stewardship Framework, offering research-based guidance for the Scotch Whisky industry as it works to improve efficiency and make reductions in its water use across the production process.

Water is one of just three ingredients for making Scotch Whisky and is used extensively across the production and cleaning process. Distilleries’ water use varies greatly according to capacity and location, but all are committed to using water as responsibly as possible in line with the industry’s wider sustainability commitments. As part of its Sustainability Strategy launched in 2021, the SWA set a target range of 12.5 to 25 l/lpa (the amount of water used per litre of alcohol produced) by 2025, depending on distillery size and production.

The Framework focuses on three key areas: Responsible use, Engagement and Collaboration, and Advocacy. These three themes aim to provide SWA member companies with clear direction on how they can address water use and efficiency improvement in their operations, while incorporating wider collaboration and advocacy activities. The Framework encourages a collaborative industry approach to deliver on-the-ground improvement projects and influence future policy to ensure the protection and preservation of a vital resource. Previous data analysed by the SWA showed that water efficiency – measured in l/lpa – had improved by 22% since 2012. The SWA will continue to gather data from across the industry to re-benchmark progress and set ambitious targets to take the sector beyond compliance on water.

Ruth Piggin, Director of Industry Sustainability at the SWA said: “Water is a precious resource which is vital as both an ingredient for making Scotch Whisky and a tool in its production. The Water Stewardship Framework is an action-orientated commitment to the industry’s continued work to improve water management, and a serious acknowledgement of the importance of water to nature and the wider environment surrounding industry sites.

“We have a duty of care to ensure our use of water is as efficient and responsible as possible.”

Ruth Piggin, SWA

“The impact of the climate crisis is already being felt in Scotland’s water supply chain, and while distilleries manage this well, we understand that we have a duty of care to ensure our use of water is as efficient and responsible as possible. We’re committed to working closely with stakeholders including SEPA, government bodies and other relevant parties, to further improve the industry’s water stewardship.”

Nathan Critchlow-Watton, Head of Water and Planning at SEPA, said: “Scotland may be renowned for its rain but, as we’ve seen already this year, it can be extremely vulnerable to periods of prolonged, dry weather and with climate change these are expected to become more frequent in the years ahead.

“The businesses that thrive in the face of this challenge will be those that recognise the link between environmental and economic prosperity. They will work with SEPA and others in their industry to build resilience, reduce their water use and have a well-established plan for when we experience water scarcity. These actions will reduce the need for SEPA to impose restrictions on their business.

“It’s reassuring to see the whisky industry being proactive, taking their responsibility to help protect Scotland’s water environment seriously, and contributing to its long-term sustainability for all those who depend on it.”