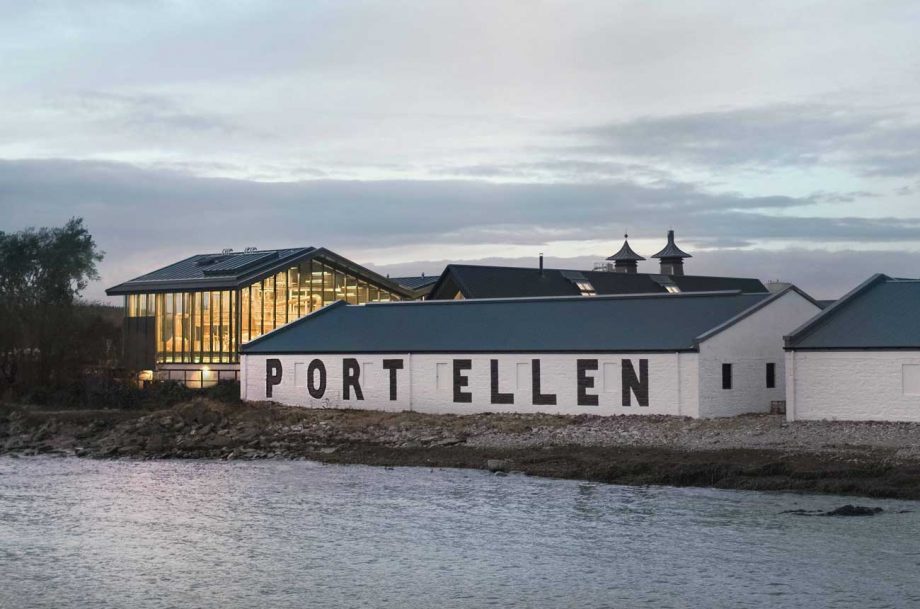

In the heart of Scotland, where the rolling hills are adorned with amber hues and the air carries the distinct aroma of peat, lies an invaluable treasure trove – whisky casks. These barrels, filled with liquid gold, are not only a testament to Scotland’s rich distilling heritage but also a significant economic asset. Stored in His Majesty’s Revenue and Customs (HMRC) bonded warehouses, the security of these whisky casks becomes paramount. WIUK ® delve into the measures taken to safeguard these precious barrels.

HMRC Bonded Warehouses: The First Line of Defence

HMRC bonded warehouses are high-security facilities designed to store goods that are subject to excise duties, such as alcohol. These warehouses play a crucial role in ensuring that taxes are paid on alcoholic beverages before they are released into the market. Whisky casks stored in these facilities benefit from the strict protocols and surveillance systems implemented to deter theft and maintain regulatory compliance.

Surveillance and Monitoring Systems: Keeping a Watchful Eye

State-of-the-art surveillance and monitoring systems are the backbone of whisky cask security. These systems employ a combination of CCTV cameras, motion sensors, and access control measures to monitor every corner of the warehouse. Any unauthorized access or suspicious activity triggers immediate alerts, allowing security personnel to respond swiftly and effectively.

Temperature and Humidity Controls: Preserving the Elixir

Whisky, a delicate spirit, matures best under specific conditions. HMRC bonded warehouses are equipped with advanced climate control systems to maintain stable temperatures and humidity levels. This not only ensures the quality of the whisky but also acts as an additional layer of security, as any attempt to tamper with these conditions would be detected promptly.

Inventory Tracking and Management: Every Cask Accounted For

Each whisky cask within the bonded warehouse is meticulously catalogued by a unique cask number and an AYS date and are tracked through a sophisticated inventory management system. This digital record-keeping enables warehouse managers to monitor the movement of each cask, making it nearly impossible for any cask to go missing without raising immediate alarms.

Physical Security Measures: Fortifying the Fortress

Beyond the digital realm, physical security measures are in place to safeguard the whisky casks. Fences, gates, and restricted access areas create a perimeter that is challenging to breach. Security personnel, trained to handle various situations, patrol the premises, ensuring a visible presence that acts as a deterrent against potential threats.

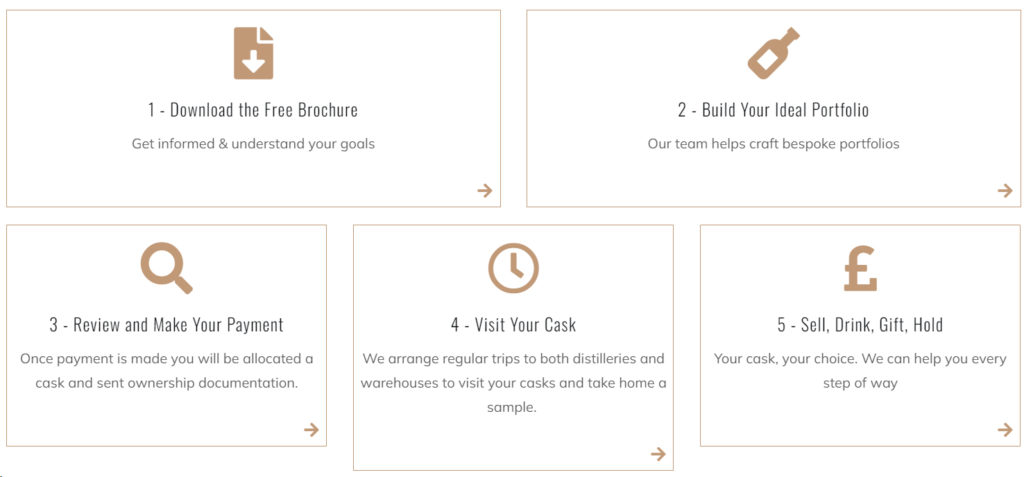

Opening a private account

Opening a private account at an HMRC bonded warehouse in Scotland involves a series of steps and considerations, as these facilities are primarily designed for businesses engaged in the import, export, and storage of goods, that hold a WOWGR licence, WIUK ® are working with several independent bonded warehouse that will open private accounts for our clients without the need of having a WOWGR licence or having a WOWGR licence.

Be prepared to provide necessary documentation when opening an account, like when purchasing a cask from WIUK ® you will need to provide personal identification, proof of address, and any business-related documents if applicable.

Clearly communicate the purpose of the private account and the type of goods (e.g., whisky casks) you intend to store.

Understand Costs and Fees:

Ensure compliance with all relevant regulations and legal requirements. HMRC bonded warehouses are subject to strict regulations, and adherence is crucial to avoid legal issues.

Security Measures:

Understand the security measures implemented by the warehouse to safeguard stored goods. This may include surveillance systems, access controls, and physical security measures.

Inventory Management:

Inquire about the inventory management system in place. A robust system ensures accurate tracking and management of stored goods.

Discuss Terms and Conditions:

Review and discuss the terms and conditions associated with opening a private account. Clarify any doubts regarding responsibilities, liabilities, and access to stored goods.

Visit the Warehouse:

WIUK® can arrange a visit to the warehouse to personally assess the facilities and discuss your needs with the management.

Storage and insurance fees:

Storage fees are typically charged based on the volume of whisky casks or pallets being stored and the duration of storage.

Warehouses may have different rates for short-term storage (e.g., a few months) versus long-term storage (several years).

Some warehouses offer tiered pricing based on the quantity of whisky being stored, with discounts for larger volumes.

Insurance fees cover the cost of insuring the stored whisky against various risks, such as theft, fire, natural disasters, and accidental damage.

Insurance fees are often calculated as a percentage of the declared value of the stored goods

Transparency:

WIUK® have spent over 2 years verting different bonded warehouse that provides transparent and detailed billing statements, outlining all charges associated with storage and insurance.

Regular communication with the warehouse regarding fees and any changes in rates is essential to avoid surprises.

WIUK® can arrange a visit to the warehouse to personally assess the facilities and discuss your needs with the management.

If you would like more information on which warehouses will open a private account, or you would like to discuss whisky cask ownership, please contact us at [email protected] or call 01343 610 224 to arrange a chat with one of our whisky experts.