How to avoid whiskey investment scams

Some brokers in the market are using unfavourable practices and like many industries, it is subject to unscrupulous people acting fraudulently to con honest investors out of their money. But this should not deter you from investing in whisky as it is such as great investment (and why these people are targeting this sector), you should however do your homework before investing.

What should you look for?

One of the first things you can look at is the company history. Is it a new company? What experience do they have in whisky investment? What licenses and certifications do they hold? What reviews are available on the company? What processes do they have in place to manage and protect your whisky investment? Will ownership of the casks be transferred to you?

You should look for a reputable company that has the experience and is licensed by HMRC to move and store alcohol under suspended duty, this regulation is called WOWGR.

Are they connected to the right warehouses to protect your assets? Cask whisky investments should be stored securely in HMRC-bonded warehouses which are designed to store goods that are subject to excise duties (such as alcohol) and they ensure the duty is paid before the alcohol is released to the market for consumption. These warehouses are designed specifically for storing alcohol with temperature controls, strict protocols and surveillance systems to deter theft and ensure regulatory compliance. Also, how will they safely transport your casks to the appropriate warehouse? A genuine company should have certification and answers to all these questions.

Ownership of the casks is also a key priority so that you have verifiable ownership of the casks and documentary evidence. How will the company provide you with this? You should always check that the cask is registered in your name at the warehouse upon completion of the purchase and the cask being stored there.

What do the reviews say about the company? Recommendations or reviews are a great way to learn more about a company from impartial people, find out more about its offerings and how they treat their customers.

Finally, look out for potential red flags such as the promise of fixed high returns or hidden costs for warehousing fees or duty payments which could indicate someone that isn’t operating reputably or acting fraudulently.

If you are at all unsure about a company and the investment opportunity, you should seek advice before investing.

What does Whisky Investment UK offer their clients?

Whisky Investment UK is part of a large organisation that has been operating for over 15 years and is FCA regulated. We are also WOWGR licensed which means we are approved and licensed by HMRC to store both bulk and cask whisky in duty suspense storage at any approved Scottish warehouse. We are a trusted whisky investment advisor and broker with a wealth of experience to help you find the right casks and we provide transparent pricing.

In 2023, Whisky Investment UK were awarded “The Best Whisky Investment Management Specialist” at the UK Enterprise Awards. The award recognised the careful and personal way that clients and their investments were handled. At Whisky Investment UK, we are trying to lead the way in the industry by creating processes that protect the client and their assets as well as deliver exceptional customer service.

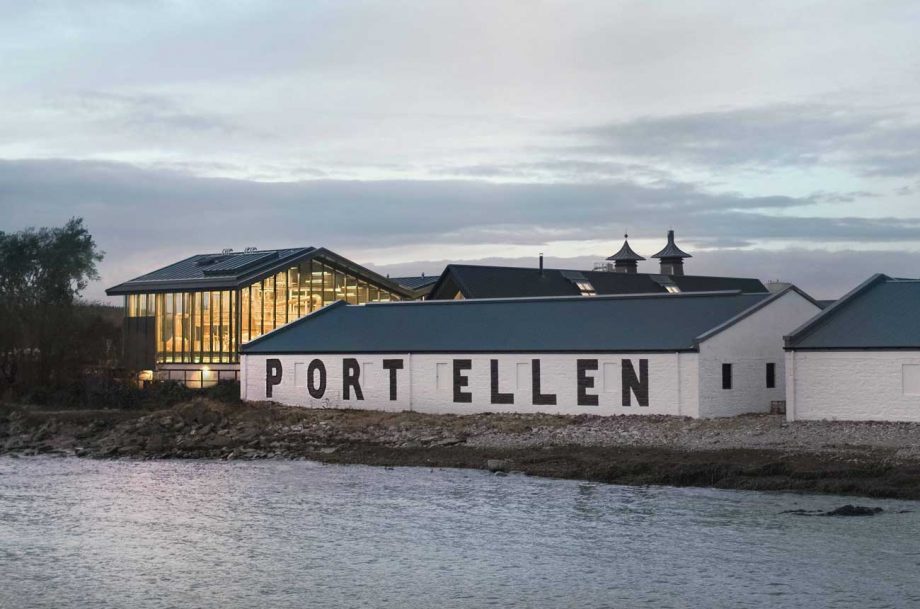

One of the things we uniquely offer our clients is that we facilitate the opening of private accounts for our clients at HMRC-approved bonded warehouses. This is an essential part of the process for clients as it provides them with 100% ownership and control over their assets as the process includes providing the client with a Delivery Order and transferring the casks to their private account. Each cask also has a unique number and AYS which gives the date it was filled which identifies and the warehouse will track your casks for you in their facilities. We can also arrange for you to visit your casks at these state-of-the-art warehouse facilities and have your photo taken with them, so you can see your casks for yourself and know that they are safe and well cared for.

The HMRC-bonded warehouses that we use have state-of-the-art surveillance and monitoring systems to protect your assets with CCTV cameras, access control measures and motion sensors. Sites are protected by fencing and gates with restricted access and security personnel to patrol the premises. They also have sophisticated inventory management systems to track all casks in their facilities.

Each HMRC-bonded warehouse is also temperature and humidity-controlled to provide the right environment to support the maturity of the whisky. So you can be reassured that your casks are in safe hands for your investment period.

If you are interested in investing in cask whisky with a reputable and trustworthy company contact us to find out more and one of our team will answer your questions and guide you through the process.